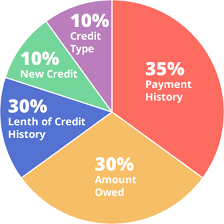

Credit scores are calculated using data compiled in five (5) categories.

Within each category values are awarded or removed based on the timeliness and relevance of the information to that category. Each factor is assigned a percentage of the credit score and then totaled. The five categories are listed below in order of value:

- Payment History – Thirty-Five Percent (35%) Paying bills on time and in full has the single greatest impact on a credit score. That should be no surprise. Late payments, delinquencies, charge-offs, collections and judgments all negatively affect a credit score to some extent. Late payment within the last twelve (12) months and delinquencies within the last twenty-four (24) months tend to negatively affect credit scores the most. It may seem counter-intuitive, but judgments don’t appear to affect credit scores as adversely as do late payments or delinquencies. That said, it is impossible to get a commercial mortgage and sometimes even an auto loan with a judgment on your credit report, regardless of how high your FICO score maybe.

- Credit Utilization Ratio – Thirty Percent (30%) Bankrate.com defines credit utilization as “the amount of credit you have used compared with how much credit you have been extended by a lender.” This category does not directly relate to how a consumer pay his/her bills, but to his future ability to pay those bills. A high credit utilization ratio could mean that a consumer is spending more than he/she earns. It could mean there are financial issues present that a credit report does not directly reveal. Or, it could simply mean that a consumer has little self-discipline when it comes to spending. In the end, it doesn’t what this category is intended to indicate, only that under ideal circumstance, this percentage should be below thirty percent (30%) and preferably below twenty percent (20%) to have a good credit score.

- Length of Credit History – Fifteen Percent (15%) This category of the credit score accounts for the length of time a particular credit line has been established. The longer a strong account exists, the more it helps to improve a credit score. Younger people with shorter credit histories often find this category troublesome since it is impossible for them to have long credit histories.

- Variety of Credit – Ten Percent (10%)A good mix of credit lines is simple way to improve your credit. There are four types of credit lines: Mortgages, Auto Loans, Revolving Credit (credit cards) and Personal Loans.

- Credit Inquiries – Ten Percent (10%) Every person is allotted a certain amount of hard credit inquires every twelve (12) months. After that allotment of inquiries is exhausted, three to fifteen points are reduced from the individual score depending on a variety of factors. A hard inquiry is defined as a credit check in response to a new application for credit. It is believed by many lenders that excessive hard inquires may indicate a consumer is seeking large amounts of credit due to financial distress and that distress could affect his/her ability to repay future debt.

IMPORTANT: There are exceptions to above rules. If you pull your own credit report, it has no effect on your credit score. Additionally, a more recent change to the hard inquiry rule permits consumers to shop for mortgages and auto loans with out adversely affecting their credit. Unlike conventional wisdom, multiple inquiries from auto, mortgage or student loan lenders within a short period of time are typically treated as a single inquiry and will have little impact on your credit score.

If you found this post helpful, please leave a comment, share it on social media or send the Monkey an email at [email protected].

Recent Comments